Signs of Life in Europe’s Tech Investment Landscape. Europe is suffering from a major hangover from the tech investment event of the period between 2020 and 2021. However, when compared to pre-pandemic numbers, VC funding for European startups has increased in the past, and has was $60 billion in the last quarter in a new report. However, the unusuality of the increase in investments due to the pandemic comes against that expansion and has led to substantial headwinds despite there are indications of ‘green sprouts’.

The global legal firm Orrick Orrick has analyzed more than 350 VC and growth equity investment transactions its clients made in Europe this year.

The total amount of capital that was raised by Europe is $61.8 billion. 2023 marked a reset, and a significant correction in the investment level across the globe. Three of the most coveted worldwide regions of VC that includes Europe, Asia, and North America – Europe is the only one that has surpassed the levels of 2023 in.

As per the research Europe is having “record levels of dry powder” and “producing more new founders than the U.S.”, however, funding remains slow.

There were only 11 new unicorns that emerged from Europe this year, which is the smallest number in a decade. increasing numbers of unicorns were deemed unworthy.

Climate Tech overtook FinTech as the most viewed sector in Europe.

AI’s share of investment in Europe increased to an all-time highest of 17%5.

Orrick discovered that investorsempowered by the slump in funding are turning the screws and exercising more control over their investments, with founders having to guarantee their warranties in three-quarters of all venture deal.

There was a significant decrease in financings at later stages, the volume of deals fell and founders were turned to other options including alternative financing methods or chasing revenue and profits.

It was the “unprecedented spike” in the capacity of investors from new sources to join tech companies, as founders sought out new investors who could lead their ventures, and there was an “uptick” in convertible debt as well as SAFEs and ASAs and convertible financing accounting for 23% of all rounds in 2023.

Investors are generally concentrated on managing their current portfolios, and secondary transactions grew as did SaaS and AI were still well-liked. However, the number of FinTech investments fell.

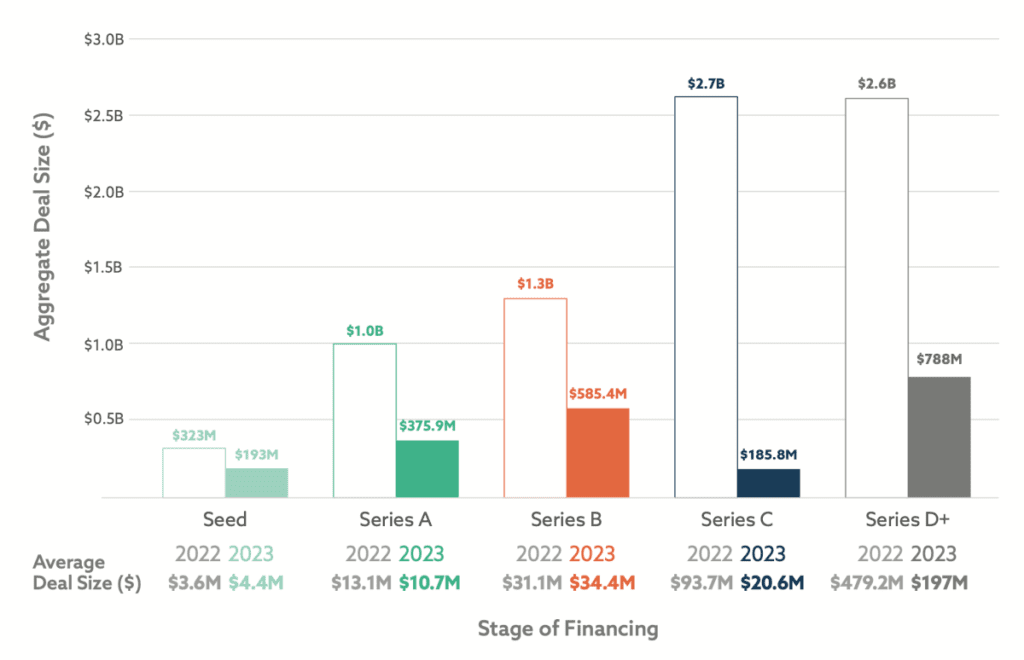

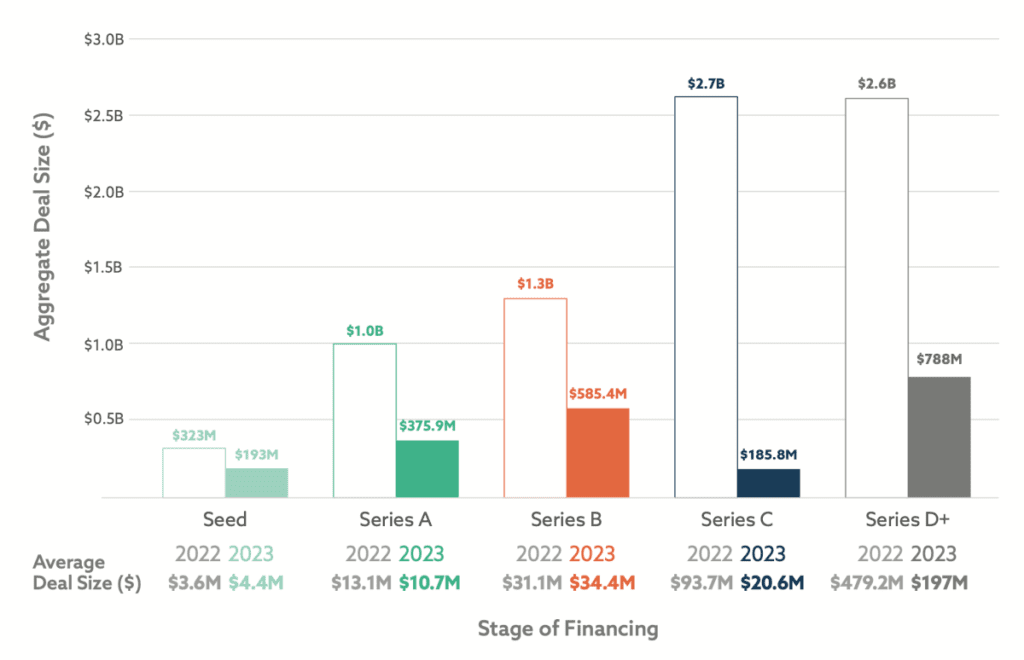

Image Credit :Orrick European VC deals report

European 2023 tech investment deals (Orrick)

At every stage the value of deals decreases and the biggest decrease in the later stages of deals.

Early-stage deal values fell to 40% the early stage investors remain among the top active investors.

There was a drop in mega-rounds that exceeded $100Mplus. However the IPO scene revealed “signs of life” with the ARM $55 billion IPO and M&A activity was a sign of “green shoots.”

Within the UK, VCs are under pressure to produce returns and this could result in a rise in demand for secondary VCs, more M&A activity, and consolidation.

In France there’s seen a shift away from “founder-friendly terms to more investor-friendly terms. This is in stark contrast to the Uk in which the reverse is the case.

In Germany there is a rising demand from LPs for liquidity is anticipated to “energize the tech M&A pipeline.”